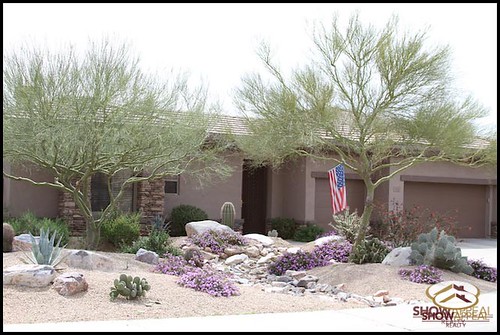

Actual Property

However, transportation expenses incurred to travel between your home and a rental property generally represent nondeductible commuting prices except you utilize your house as your principal place of work. 587, Business Use of Your Home, for data on determining if your house workplace qualifies as a principal place of work. You can deduct mortgage interest you pay on your rental property. When you refinance a rental property for greater than the earlier outstanding stability, the portion of the interest allocable to loan proceeds not related to rental use usually can’t be deducted as a rental expense. If you generally use your rental property for private purposes, you have to divide your expenses between rental and personal use.

Transfer Of Property Rights After Dying: Placing Heirs On Title Of Actual Estate

Real estate fee is usually 5-6% of the house’s sale value. That fee is normally cut up between the client’s and seller’s agents and is paid by the vendor at the time of closing.

Neighborhood Property

The mid-month conference is taken into account within the percentages shown within the table. Continue to make use of the same row underneath the column for the suitable yr. You purchased a stove and refrigerator and positioned them in service in June. Your foundation in the stove is $600 and your foundation within the fridge is $1,000. Using the half-yr conference column in Table 2-2a, the depreciation share for Year 1 is 20%. For that year, your depreciation deduction is $a hundred and twenty ($600 × zero.20) for the range and $200 ($1,000 × zero.20) for the fridge.

It isn’t restricted to amounts you receive as normal rental funds. Chapter 5 discusses the foundations for rental revenue and bills when there may be additionally private use of the dwelling unit, such as a trip home. These are two frequent types of residential rental activities mentioned in this publication. In most circumstances, all rental earnings should be reported in your tax return, however there are variations in the bills you might be allowed to deduct and in the best way the rental activity is reported in your return. NIIT is a 3.eight% tax on the lesser of net investment revenue or the excess of modified adjusted gross earnings over the brink quantity. Net investment earnings might embody rental revenue and other revenue from passive actions. invested in real property notes in the past through an individual investor I know who purchases and renovates property.

Vanguard’s VNQ, for instance, is an actual estate ETF that invests in stocks issued by real property investment trusts that buy office buildings, hotels, and other types of property. IYR is one other real estate ETF that works similarly because it presents targeted access to domestic actual property stocks and REITs. Whether you’re a buyer, vendor, or realtor, it’s important to remain updated on current real property trends and market fluctuations.

Properties On Property On The Market In Sarteneja, Corozal Belize

The document outlines the terms and circumstances of a sale and holds each get together legally accountable to assembly their agreement. If a homebuyer makes a down payment of less than 20% of the purchase value of a home or is the recipient of an FHA or USDA mortgage, they’ll often be required to pay mortgage insurance.

You can deduct the utility fee made by your tenant as a rental expense. If your tenant pays any of your bills, those funds are rental income. Because you have to embrace this quantity in revenue, you can also deduct the expenses if they’re deductible rental bills. When you report rental revenue in your tax return generally is dependent upon whether you’re a cash or an accrual foundation taxpayer. In most instances, you should include in your gross income all quantities you obtain as hire. Rental revenue is any payment you obtain for the use or occupation of property.

You built a brand new home to use as a rental and paid for grading, clearing, seeding, and planting bushes and timber. Some of the bushes and bushes had been planted right subsequent to the house, while others had been planted across the outer border of the lot. If you replace the home, you would have to destroy the bushes and bushes proper subsequent to it.